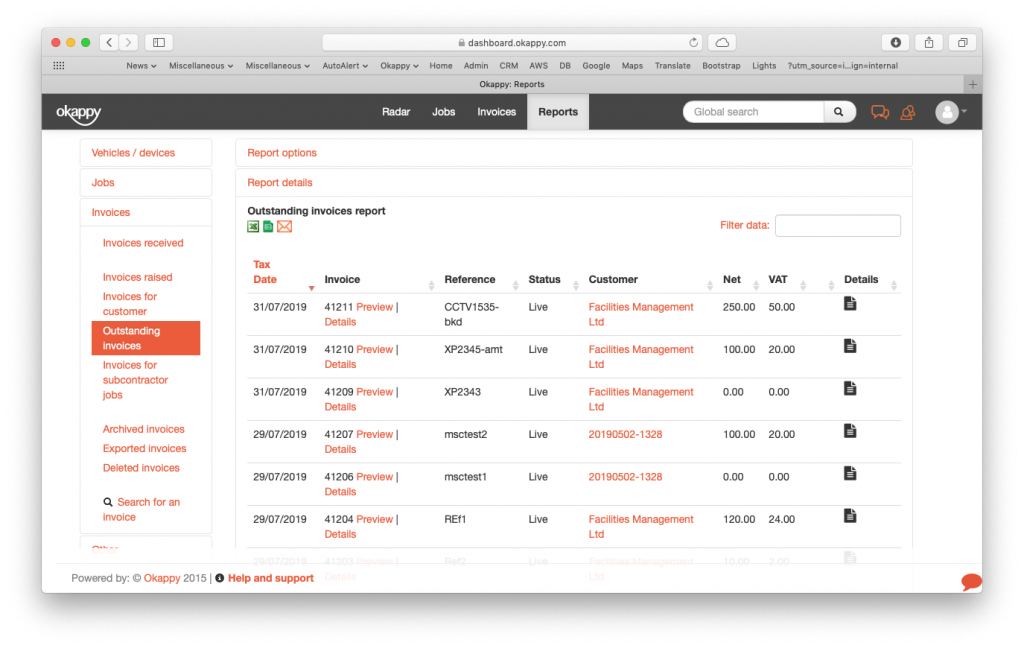

To do so, establish rules and regulations right from the start: prevention is always better than cure. A few simple steps to reduce invoice follow-up stressĪs a small business owner or entrepreneur, it is best to eliminate the problem from the start by preventing the situation from happening.How long can you chase an unpaid invoice?.4 – Your rights are not covered in your contract.2 – Your client is not satisfied with your product or service.1 – Your company’s approach is too laid back:.4 Main reasons companies give for unpaid invoices.This article aims to provide solutions to prevent overdue invoices and reduce invoice follow-up stress. Setting up ways to prevent late invoices and successfully chasing overdue bills are essential skills to master for small businesses. Eventually, they can render a business insolvent. Outstanding invoices can be lethal for a business, as they affect cash flow and affect the ability to pay staff, suppliers, rent, and more. The report also found that UK companies pay their employees an average of 18 days late. The UK averaged 66%, the US 71%, and Europe 73%. MarketInvoice discovered that in 2017, 62% of invoices were paid late. Regrettably, this is an ongoing problem for SMEs. And as small businesses, freelancers, and entrepreneurs are usually the last in the work chain they are often the final ones to be paid.

Processing overdue payments and outstanding invoices can be uncomfortable, especially when maintaining a good client relationship.

“Late payment is the silent killer of modern business”Īnil Stocker, co-founder and CEO, MarketInvoice

0 kommentar(er)

0 kommentar(er)